By Charudutt Sehgal

Introduction

The economic progress of a nation and development of its banking sector is invariably interrelated. The banking sector is an indispensable financial service sector supporting development plans through channelizing funds for productive purpose, intermediating flow of funds from surplus to deficit units and supporting financial and economic policies of the government. Banks serve social objectives through priority sector lending, mass branch networks and employment generation. Maintaining asset quality and profitability are critical for banks survival and growth. In the process of achieving such objectives, a major roadblock to banking sector is prevalence of Non-Performing Assets (NPA). In India, the problem of bad debts was not taken seriously until it was mandated by the Narasimham and Verma committee. The committee mandated the curbing of the particular issue because NPA direct towards credit risk that bank faces and its efficiency in allocating resources.

The aim of this research paper is to study the current trend of NPAs in Indian scheduled banks (up to 2013-14 only). The paper further examines the critical reasons behind the rise of this issue, its impact on Indian banking sector and Indian economy. In order to understand the criticality of the problem an effort has been made to study what impact NPAs have on ease of doing business rankings. Furthermore, the paper concludes with some of the important measures which if implemented then can improve the current scenario of NPAs in SCBs.

NPAs in Indian scheduled commercial banks

In order to analyze the core issue, we need to study the data related to it. Figure 1 showcases gross NPAs and Net NPAs during the period of 2001-02 to 2013-14. The data shows that Gross NPAs increased from Rs. 708.61 billion in 2001-02 to Rs.2642 billion in 2013-14. Similarly, Net NPAs also increased from Rs.355.54 billion in 2001-02 to Rs.1426.57 billion in 2013-14. The figure also showcases the trend of how NPAs have moved over the years. The NPAs declined till 2006-07 but from 2006-07 there is an upward rise in NPAs. As in 2016, the PSBs accounts for gross NPAs of around Rs.3.06 lakh crores which is more than the size of the budget of Uttar Pradesh.

Figure 1: Gross and Net NPAs of Scheduled Commercial Banks

Causes

On a global scenario, there can be numerous reasons for rising NPAs such as global slowdown, economic crisis, fall in domestic demand etc. However, pertaining to the Indian banking sector, there are certain other issues that cater to the rise of NPAs. These issues are:

- Wilful defaulters, fraud, mismanagement and misappropriation of funds.

- Lack of proper pre-appraisal and follow up.

- Under financing

- Delay in completing the project.

- Business failures

- Deficiencies on the part of bank viz., in credit appraisal, monitoring and follow ups.

Apart from above stated points, three main issues that are contributing heavily to the rise of NPAs of banks, are as follow:

Lending to the priority sectors

The concept of priority sector officially came into picture in 1972, after the National Credit Council emphasized that there should be a larger involvement of the commercial banks in the priority sector. In 1974, the banks were given a target of 33.33% as share of the priority sector in the total bank credit. Later this rate was revised to 40%. RBI has divided the priority sector into categories like agriculture, small scale industries, small businesses, state sponsored organizations for SC/ST, education loan, housing loan, consumption loan, micro credit, loans to software industry, food and agro processing sector, venture capital and export credit.

Figure 2: Trend Analysis of NPAs in Priority Sector

From the above chart, we can easily analyze that PSBs have been giving advances to priority sector with an annual growth in every successive years. There exists a general opinion that banks have more NPAs from advances made to priority sector, as the borrowers don’t have sufficient means to repay the loans. Public Sector Bank’s NPA’s in the priority sector have shown a slow decreasing trend from 2001-02 to 2005-06. From 2006-07 onwards the trend is not constant but mostly it shows an upward trend till 2010-11. The PSB’s witnessed an alarming increase in their share of NPA’s during the period 2009-10 and 2010-11. It can also be observed that the NPA’s rose by Rs. 16105.66 crores in the last 10 years.

Lacklustre recovery of loans by banks

Presently, Lok Adalats, DRT and SARFAESI are the common methods sought for credit recovery. We will try to analyze the recovery process and various channels through their statistics.

Figure 3: Percentage of Recovery of Loans by Various Channels

The SARFAESI Act even though being the best mode of recovery, still provides the recovery of only 25% of the total loan amount. The number of cases referred in all the channels and the amount recovered increased successively every year but the percentage of the amount recovered to the total amount still remains very low. Thus, it shows that though recovery channels were contributing in recovering the NPA’s but that was still not enough.

Restructured portfolio

Global economic slowdown has affected all the countries and India is no exception to that. Various Indian sectors like agriculture, manufacturing, service etc. have been facing slowdown. The following data showcases the net NPA’s held by various Indian sectors as on.

Table 1: Sectoral NPAs as on 31st March, 2013

Source: Financial Stability Report, June 2013

In order to aid these sectors, Indian banks have been restructuring the advances provided through measures like interest rate reduction, extension of repayments etc., so as to bring back them to the normal state. A major part of restructuring involves corporate debt restructuring. The following data showcases the amount of restructuring done by banks in recent years:

Table 2: Restructured advances of all SCBs (Rs. In Lakh crores)

Source: Economic Times & Financial Stability Report June 2013

The increasing restructured advances majorly affects bank’s profitability and capital adequacy, further leading to the rise in NPAs.

Comparison with the world economies

In order to better understand the loan recovery system of India we shall compare our economy with the world economy on the basis of World Bank’s data. According to the data, India ranks 183rd among 196 countries in terms of loan recovery time and 149th in terms of loan recovery percentage. India’s poor loan recovery process affects its ease of doing business rankings also. As per World Bank’s data, India ranks 136th in ease of resolving insolvencies and 130th in ease of doing business 2017.

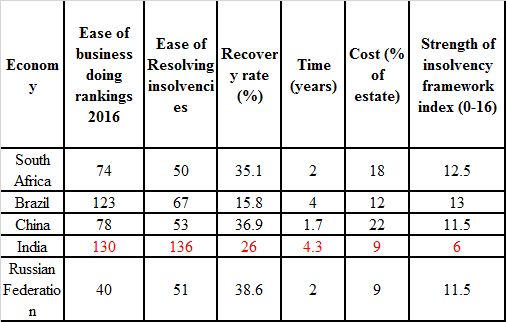

Table 3: Ease of Business doing rankings (and other parameters) of BRICS nations

Source: http://www.doingbusiness.org

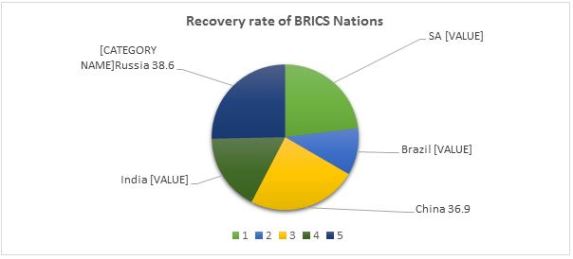

Figure 4: Recovery rate of BRICS Nations

Table 3 and Figure 4 showcases the comparison of India with other BRICS nation in terms of recovery rate of loans provided and the ease of doing business rankings. India ranks the lowest among all the BRICS nations in ease of doing business as well as in ease of resolving insolvencies. The recovery rate of India, which is 26%, is lower than other nations, except for Brazil. India lags behind other BRICS nations in terms of time to recover credit, which is 4.3 years, and the strength of insolvency index, which is 6.

Figure 5 showcases the comparison of recovery time and rate between the top five countries (of insolvency resolving index), G7 member nations and BRICS countries. Further analysis of the World Bank’s data reveals that India takes 7 times more amount of time in recovery of loans as against Japan. The amount which is recovered is less than 1/3rd the amount recovered by Japan.

Figure 5: Comparison of recovery time and recovery rate

Source: http://www.doingbusiness.org

This data clearly reflects the poor loan recovery process of India and asks for some corrective and immediate actions like strong Bankruptcy law so as to reduce the time taken for completing the insolvency process.

Impact of NPAs on banking sector and Indian economy

In today’s era of globalization, the role of banking sector is not limited to providing financial resources to the needy sectors but the banks act as agents of financial intermediation and also plays a major role in the fulfillment of social agendas of the Government. However, a steady rise in the NPA’s of banks affects not only the banking sector but the country’s economy as a whole.

Firstly, NPAs leads to asset contraction for banks. Due to the presence of NPAs, the banks follow low interest policy on deposits and high interest policy on advances provided. Thus, this act puts a pressure on recycling of funds and further creates a problem in getting new buyers. Secondly, as per the Basel norms all banks are required to maintain capital on risk weighted assets. A rise in NPAs pressurizes the banks to increase their capital base further. Lastly, rise in NPAs reduces the customer’s confidence on the banks. Rise in the NPAs affects the profitability of the bank which further hinders the returns to be received by the customers. Decrease in profits leads to a lower dividend pay-out by the banks and affects the ROI expectations of the customers. Thus, a rise in NPAs not only affects the performance of the banks but also affects the economy as a whole.

Remedies/Measures for managing NPAs

Banks today have a herculean task of both effectively managing the NPA’s as well as keeping their profitability intact. In order to achieve this, the banks need a well-established credit monitoring system. Since, lending forms a major segment of bank’s transactions thus they need to properly evaluate the credit proposals they receive. Full information related to the client/company, industry, management etc. should be collected. A centralized model for sanctioning and recovery of loans should be setup. Staff with specialized skills in credit risk management must be hired. Timely watch on the performance of the borrowers must be kept so that recovery of instalments becomes easy. In conclusion, proper monitoring system and effective business models need to be developed in order to resolve the gigantic problem of NPAs.

Conclusion

NPAs have not been a problem only for the banks but has been a problem for the economy too. The money locked up in NPAs has a direct impact on profitability of the banks as many Indian banks are highly dependent on interest income. Though many steps have been taken by RBI and the government to reduce NPAs but they are not enough to curb it. The government needs to speed up the recovery process of loans and also need to reduce the mandatory lending to priority sector as it is one of the major contributor to bank’s NPAs. Also, right fiscal and monetary policies along with RBI’s strict supervision is needed to eradicate this disease from its root.

Bibliography

- Retrieved January 6, 2017, from http://www.rbi.org/

- Resolving Insolvency – Doing Business – World Bank Group. Retrieved January 6, 2017, from http://www.doingbusiness.org/data/exploretopics/resolving-insolvency

- Debts Recovery Tribunals and Appellate Tribunals. Retrieved January 7, 2017, from https://www.drt.gov.in/Pendency.aspx?page=DRTSADisposal

- Singh V. R. (2016). A Study of Non-Performing Assets of Commercial Banks and its recovery in India. Retrieved January 09, 2017, from http://www.scmspune.ac.in/chapter/2016/Chapter%209.pdf

- Selvarajan B., & Vadivalagan D. G. (2013). A Study on Management of Non-Performing Assets in Priority Sector reference to Indian Bank and Public Sector Banks (PSBs), 13(1). Retrieved January 15, 2017, from https://globaljournals.org/GJMBR_Volume13/10-A-Study-on-Management-of-Non.pdf

- Shalini H. S. (2013, January). A study on causes and remedies for non-performing assets in Indian public sector banks with special reference to agricultural development branch, state bank of Mysore, 2(1). Retrieved January 22, 2017, from http://www.ijbmi.org/papers/Vol(2)1/Version_1/D212638.pdf

- Non-Performing Assets Impact on Bank Balance Sheet. Retrieved February 1, 2017, from http://www.allbankingsolutions.com/Articles/NPA-impact-on-Balance-Sheet.htm

About the Author

About the Author

Charudutt Sehgal is currently a first-year student of PGDM Batch 2016-18 at TAPMI. His interest areas are Corporate Finance, Macroeconomics, Cost accounting and Financial Modelling. He also has a keen interest in Banking and current issues related to the sector. You can reach him at: cds0905@gmail.com